You’ve probably tried using a budget spreadsheet before. Maybe you’re even using one right now.

But are you happy with it? Is it working for you? Probably not.

Budget spreadsheets seem to fall into the same category as new year’s fitness plans.

You feel like you should use one. And you want to handle your money better.

But it just doesn’t give you the information you need. So you get frustrated and stop using it.

But what, exactly, is it missing? Why doesn’t it work for you?

Why do you need a budget spreadsheet?

Let’s go back to the basics for a moment. Most of us don’t have unlimited funds available. That means we need to pay attention to how we spend our money.

We need to use the income we have to ensure we can pay our bills.

And not just the basics: food and shelter. We want to enjoy our lives too!

So, plain and simple – you need a way to keep track of your money:

- How much money do you have available to spend

- How is that money being spent (or how should it be spent)

Reality check

If you want to know what’s happening with your money then you MUST track it. And tracking it requires effort on your part.

I’m really sorry if you were looking for a little bit of magic to make it all “easy.” But if you really want to understand your money situation, READ ON!

If you don’t want to create a spreadsheet from scratch, you just want to skip ahead to a ready-made spreadsheet… I can help with that.

I’ve enhanced my own budgeting spreadsheet to provide you with the tools you need. Planning, tracking, AND forecasting your budget.

It’s what I’m actually using myself. Because it works.

What’s wrong with most budget spreadsheets?

Hindsight is 20/20

Tracking your expenses after the fact is easy. You can see what happened in your account, there’s no guessing.

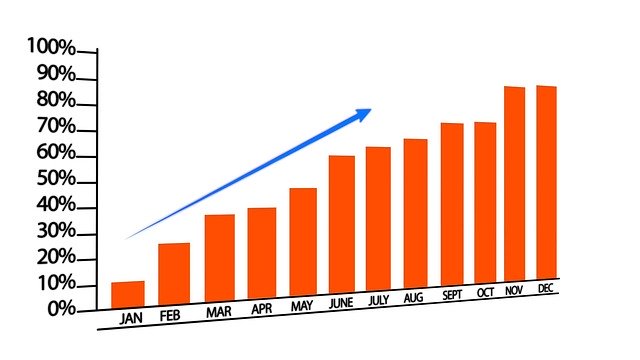

And that’s what most budget spreadsheets provide – hindsight. They give you a great view of what has already happened.

The biggest problem with most budget spreadsheets, is the lack of foresight (forecasting).

That is still useful information. Seeing how your money was distributed is helpful.

But past transactions do not necessarily give you a good picture of what will happen in the future. Especially when there are big changes in your immediate future – marriage, home purchase, children, new job, etc.

What you can’t see is how your account will look three or four months from now. How can you plan effectively when you don’t know the forecast?

Now maybe you’re thinking it’s impossible to forecast. There are always unexpected expenses.

Well, yes. There are. But if you don’t have a roadmap to begin with, then those surprises can become huge emergencies!

Cookie cutter

Another issue with most budget spreadsheets is the lack of customization. You really need something that will cover all your transactions.

More options within the spreadsheet will give you more choices to help pinpoint your own situation. And that helps your planning.

Metrics

One of the features you’ll find in most budget spreadsheets is statistics or reports. This is really great information to have so you can evaluate how you spend your money.

But often, the charts just give you one perspective, one view. Again, they just don’t have the flexibility to adapt to your personal situation.

What should be included in a budget spreadsheet?

All right, you’ve accepted the fact that you need to track your budget. And you’re putting your best foot forward to start planning.

Where do you start?

Start with a blank spreadsheet. You’ll be entering both text and numbers and you’ll want calculations to be performed automatically. So a spreadsheet is the most logical choice.

Income

Honestly, you could start anywhere. But I recommend starting with your income because you’ll get feedback faster. Small wins. ?

Income is likely to be a much smaller group of transactions than your expenses. Plus, income usually has clearly identified sources.

1. Employers

Begin with your primary employer. Enter the amounts and the dates on which you are typically paid.

Then add any secondary work – part-time job, gig-work (ride-sharing driver, food delivery), etc. The dates are likely standard but the amounts here might vary so you’ll need to estimate.

2. Occasional income

Now consider all the other sources of income you might have. At first, you might think you don’t have any additional sources of income.

But, what about annual bonuses? Or what about tax refunds? These would be additional income items.

Also, think about interest income, investment income (EG. dividends), reimbursements of any business expenses, etc.

Expenses

This is where the real work begins. It’s likely you have many more expenses than you do income.

You’ll need to “deep dive” into your past. Use your online banking history, your credit card statements, insurance policies, tax information, etc.

1. List of transactions

Look at the previous month. You’ll want to browse a month that is already completed, not a month in progress.

In your spreadsheet, enter EVERY transaction that occurred. I know it’s tedious. But this planning activity is something you only need to do once!

2. Categorization

Evaluate the transactions from that month. You need to group these into logical categories.

Start with the larger, more obvious categories like Housing, Food, Transportation. Then add smaller groups like Insurance, Health/Medical, Recreation, etc.

This is YOUR budget spreadsheet, you can group items any way you like!

3. Expand in increments

Don’t move to this next step until you’re comfortable with your categories. Once you are, then browse the next previous month. Translation: “the next previous” month is the month before the previous month.

You want to add any NEW transactions from that next previous month to your list.

After you’ve added all the new transactions, you’ll evaluate the groupings. For each new transaction, identify the respective grouping or category.

You might need to add new categories if a transaction doesn’t fit within what you already have.

4. Repeat

One-by-one, work through every previous month. Continue evaluating each month until you have completed one entire year of transactions.

The span of one year should have identified all the potential unique or occasional expenses. These are expenses that don’t occur every month or on a set frequency.

Some examples of these types of transactions: tax refund, vehicle registration, dentist appointments, etc.

How do you start building your budget spreadsheet?

You have your list of transactions. And they’re all neatly categorized with dates across an entire year.

Now you can start to build out your budget plan.

You want to ensure you use the same category for the same transaction type consistently throughout your budget spreadsheet. So package your categories and sub-categories (the type of transaction) in a separate worksheet (tab) for reference.

With your structure in place, you need to consider your scope. What do you want to include in your spreadsheet? What will help you forecast your future balances?

1. Template

Update your structure worksheet to include the expected transaction amounts. Each sub-category will have an expected amount.

You’ll also need to identify the expected transaction date. And some means of understanding the frequency of the transaction.

2. Logging

Determine how you’ll log, enter, your actual transactions. At a minimum, you need the amounts and the dates on which they occur.

But you also want to consider how you’ll capture online banking references like transaction confirmation numbers. And you may want a means to add notes to the transactions so their purpose was clear.

Most importantly, you need to ensure you can sum the transactions in a way that’s logical for you. Perhaps monthly totals or some other timeframe.

3. Reports/Metrics

Decide how you’ll display your transactions. Generally, you’ll want some visual means to help you understand the distribution.

4. Forecasting

Use your structure template (the list of transactions and categories) along with your transaction logging. This information together maps out your expectations over the year.

Now you have a roadmap! This is where you’ll see when your next bills are due. This is where you’ll see when you have enough money saved for a special purchase. Or you’re about to incur extra fees or charges.

Alternative Budget Spreadsheet

If you’re not comfortable with your spreadsheet skills or you would prefer a ready-made template, then there is another option.

I’ve enhanced my own budget spreadsheet for your use. You still need to evaluate your expenses and set up the spreadsheet with your data. But the structure and the calculations and the reporting metrics/charts already exist for you.

If this sounds more your style, then check out the information below:

How to Use the Budget Spreadsheet

Overview

Setup

Data Entry – MS Excel

Dashboard – MS Excel

Details – MS Excel

Data Entry – Google Sheets

Dashboard – Google Sheets

Details – Google Sheets

Your budget spreadsheet doesn’t have to fail

You don’t need to suffer with a frustrating budget spreadsheet. You CAN get the information you need to track your money.

Planning ahead is still critical here. You still need to understand your transactions and when they occur.

The real reason most budget spreadsheets fail is the lack of forecasting.

They don’t give you a view of your account over the short term future. And certainly not long term.

You need a tailored spreadsheet designed to give you a forecast for the entire year:

- You start by identifying your list of transactions. Begin with income and expand into expenses.

- Outline recurring transactions, their dates and frequencies

- Categorize the types of transactions and then further sub-categorize

- Work through an entire year of past data to ensure you have everything covered

- Plug this “template” into a spreadsheet

- Add a means of logging your transactions

- Include relevant reporting

- Add your annual forecasting

And, of course, you could choose a budget spreadsheet already formatted to provide you this structure. It’s the spreadsheet I actually use myself!

Like This Post? Put a Pin On It!

Did you find this article useful and helpful?

Share this WOWIT post on social media!

Have some suggestions of your own?

Click the Submit Comment button below to let us know!

Want More?

Would you like to learn more about this topic? Or perhaps explore some other topics? Choose from one of the categories below to see more:

Subscribe to our newsletter to have information delivered right to your inbox.